Public Liability Insurance for Markets Stall Holders

One Day Insurance for Market Stalls from $35.00

Instantly Receive Your Certificate of Currency and No Excess!

The Finders Keepers Market, Image taken by Samee Lapham

With AUZi, you can rest assured knowing that our sophisticated digital system will instantly generate an accurate quote based on your requirements for your Market Stall Insurance. Upon purchasing, your Certificate of Currency will be immediately emailed and available in your MyAUZi Account. We also offer One and Three day Market Stall Insurance options.

Why AUZi's Market Stall Liability Insurance?

The Benefits

- Instant Quotes & Certificate of Currency

- Add Interested Parties at any time

- Purchase Online, 24/7

- Nil Excess

Stall Holder Types Include

- Fresh Produce, Food, Drinks

- Artisan, Arts & Crafts, Handmade Products

- Clothing, Fashion accessories

- Plants, Glassware and so much more...

How Much is Public Liability Insurance for Market Stalls?

The cost of insurance for your Market Stall Holder Insurance is influenced by a number of different factors, including the Limit of Liability needed, what State you operate in, and whether you require both Public and Products Liability or simply Public Liability Insurance. You can obtain a custom quotation in under a minute, just select the Get A Quote button.

Market Stallholder Insurance Options

1 or 3 Day Cover

from $35.00

at $10,000,000 Liability

Your Choice:

- $10mil or $20mil Limit of Liability

- Public Liability or Public & Products Liability

3 or 6 Month Cover

from $85.00

at $10,000,000 Liability

Your Choice:

- $10mil or $20mil Limit of Liability

- Public Liability or Public & Products Liability

Annual Cover

Lowest Daily Rate

from $135.00

at $10,000,000 Liability

Your Choice:

- $10mil or $20mil Limit of Liability

- Public Liability or Public & Products Liability

Our Stallholder Insurance has No Excess

Do you need Public Liability Insurance for a Market Stall?

Yes. To trade at a market (aka fete, fair, show, festival etc) the Organiser can make public liability insurance compulsory for Market Stall Holders. They may also require you to have Products Liability Insurance and specify which limit of liability is required. I.e. Most council organised markets will require $20,000,000

Although, Liability insurance isn’t just a box to check – it’s an essential part of protecting your business and livelihood against financial ruin.

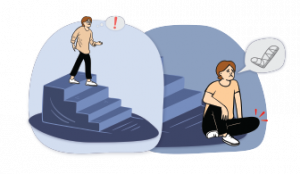

There are many risks associated with operating a market stall that could result in a claim. If you are found to be at fault and are without the correct cover, this could cause financial distress and prevent you from trading.

Can we offer Single Day Market Stall Insurance?

Yes. At AUZi, we live in the real world. If operating at the markets isn’t a regular event for you, or you’re simply dipping your toes into the realm of Market Stalls – our One-Day cover option could be for you. For more on pricing, click here.

What does AUZi's Insurance for Market Stalls Include?

Public Liability Insurance

Public Liability Insurance is designed to protect you and your stall against Personal Injury or Property Damage arising from your market stall activities.

Automatically Included in this Policy.

Products Liability Insurance

Products Liability Insurance is designed to protect you against Personal injury & Property damage arising from the products you have sold at the markets.

Optional Add-on to this Policy.

What is Public Liability Insurance for Market Stall Holders?

Public Liability Insurance for market stalls protects against Personal Injury and Property Damage claims arising from Market Stall Holder activities. For example, while you’re setting up your stall, you accidentally scratch the Stall Holder/Third Party’s car next to you with your marquee or table. Subsequently, the Third Party holds you responsible for the damages to repair their car. In this instance, your Public Liability Insurance will protect you with a Nil excess.

As a Stall Holder/business owner, claims of this nature and worse can be brought against you at any time. Therefore, it is highly recommended to safeguard yourself and your business. Otherwise, it could potentially ruin not only your business, but your livelihood and all your hard-earned assets – regardless of your industry.

What is Products Liability Insurance for Market Stall Holders?

Want to get down to the nitty-gritty of Public Liability Insurance? Square has written a great article that explains it all in-depth – read it here.

Or if you’re after some Market Stall inspiration, look no further than The Finders Keepers page on Pinterest – Check it out here.

Got a Question?

Here's some of our Frequently Asked Questions for Market Stall Holders;

How quickly can I obtain my Market Insurance?

In a matter of minutes. Our system is designed to make the purchase process as quick and easy as possible.

The quotation and application process takes a few minutes and if you arrange payment via credit card, you will have instant cover and a Certificate of currency immediately.

Can I add Interested Parties to my Market Insurance?

Yes, of course!

You can add an interested party when completing the application form.

Alternatively, you can add and remove Interested Parties via your MYAUZi account at any time.

Log in to your MyAUZi Account here if you have already purchased a Policy.

Can I increase my Limit of Liability after purchase?

Yes, you can increase your Limit of Liability to $20,000,000 by logging in to your MyAUZi account and selecting the UPGRADE COVER option, following the online prompts. It only takes a couple of minutes to complete and your revised Certificate is available immediately.

How do I get a Certificate of Currency?

Your Certificate will be automatically emailed to you after payment and it is also available for download at the end of your application, via your MyAUZi Account.

Can my Market Stall Insurance Cover me for Online Sales?

While our standard Annual Market Stall Insurance cannot cover you for eCommerce or Digital sales, our Annual Plus Option can (up to $10,000 in sales).

You can choose the Annual Plus option while obtaining your Quote.

However, if you attend only a limited amount of Markets throughout the year and rely more-so on eCommerce – you may find that we have other Policies that could be more suited to your business needs. Soap, Candles, Jewellery, and Beauty Product cover are just a few of these options.

Proudly Partnered With:

Your Dedicated Contacts

Chat live with our Specialist Brokers, Nicole & Tracy by hitting the live chat bar below. Only available during Office hours.

Alternatively, give us a call on 1300 939 698, or email us at mail@auzi.com

Implications of Cancelling your Product Liability